November 3, 2020

Are You Ready? Tax Planning for Any Election Outcome

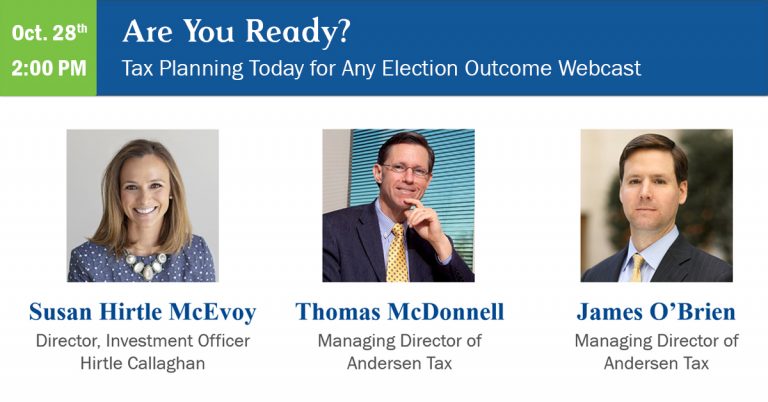

The upcoming election could dramatically change the tax landscape. It is critical that you be prepared for any outcome! On October 28, 2020, Susan McEvoy led a conversation with experts from Andersen Tax about practical planning strategies to consider before year-end. NOW is the time to review your tax and estate plans and prepare to take action before year-end. There has never been a better time to lock in low tax and interest rates. Some action items we highlighted include:

Maximize your lifetime gift/estate tax exemption before December 31, 2020

Implement estate planning strategies to take advantage of current low-interest rates

Be prepared to accelerate income and long-term capital gains in 2020

Remember the CARES Act eliminates required minimum distributions (RMDs) for 2020

If you are considering changing domiciles, stay current on evolving state-by-state complexities

If you would like to access the replay of the webcast, please Contact Us.